Crypto Loans India

क्रिप्टोकरेंसी के आगमन ने वित्तीय प्रणाली में क्रांति ला दी है, और इसके साथ ही नए वित्तीय उपायों की दिशा में भी द्वार खोल दिया है। विशेषकर, क्रिप्टोकरेंसी के बढ़ते प्रभाव से भारत में क्रिप्टोक्रेडिटिंग की लोकप्रियता में वृद्धि दिखाई दे रही है। क्रिप्टोक्रेडिटिंग, जिसे क्रिप्टो ऋण भी कहा जाता है, एक प्रकार की वित्तीय सेवा है जिसमें व्यक्ति अपने क्रिप्टोएसेट्स को गिरवी देकर वित्तीय मदद प्राप्त कर सकता है।

क्रिप्टोक्रेडिटिंग की विशेषता यह है कि यह व्यक्तिगत ऋणों के पास विभिन्न वित्तीय संस्थानों के माध्यम से नहीं आता है, बल्कि यह समर्थन करने वाले लोगों द्वारा प्रदान किया जाता है जो अपने क्रिप्टोएसेट्स को उधारी देते हैं। यह उधारण देने वाले व्यक्तियों के लिए एक तरह से निवेश होता है, जिसके माध्यम से वे अपने क्रिप्टोएसेट्स को नियंत्रित कर सकते हैं और साथ ही आय प्राप्त कर सकते हैं।

भारत में क्रिप्टोक्रेडिटिंग की पैदावार बढ़ रही है और कई प्लेटफ़ॉर्म्स उपयोगकर्ताओं को यह सुविधा प्रदान कर रहे हैं। ये प्लेटफ़ॉर्म उपयोगकर्ताओं को उचित ब्याज दर पर उधार देने के लिए उनके क्रिप्टोएसेट्स को गिरवी देने का विकल्प प्रदान करते हैं। इसके साथ ही, ये प्लेटफ़ॉर्म्स उपयोगकर्ताओं को उनके क्रिप्टोएसेट्स को सुरक्षित ढंग से संभालने की भी सुविधा प्रदान करते हैं।

एक ऐसा प्लेटफ़ॉर्म जो भारत में क्रिप्टोक्रेडिटिंग की सेवाएं प्रदान करता है, है Cropty. यह प्लेटफ़ॉर्म उपयोगकर्ताओं को उनके क्रिप्टोएसेट्स को गिरवी देने के आधार पर ऋण प्रदान करता है। यह एक सुरक्षित और पारदर्शी प्रक्रिया के माध्यम से उपयोगकर्ताओं को ऋण प्राप्त करने का अवसर प्रदान करता है, जो उनके वित्तीय आवश्यकताओं को पूरा करने में मदद कर सकता है।

क्रिप्टोक्रेडिटिंग के माध्यम से व्यक्तिगत वित्त का प्रबंधन करने का यह नया तरीका वास्तविकता में उपयोगी हो सकता है, लेकिन यह ध्यान देने योग्य है कि यह उधारण की प्रक्रिया होती है और यह निवेश के साथ जोखिम जुड़ा होता है। इसलिए, यदि आप क्रिप्टोक्रेडिटिंग का उपयोग करना चाहते हैं, तो आपको सावधानीपूर्वक और समझदारी से निवेश करना चाहिए।

कुल मिलाकर, क्रिप्टोक्रेडिटिंग एक नवाचारिक वित्तीय सेवा है जिसने भारतीय व्यक्तिगत वित्तीय प्रणाली को परिवर्तित कर दिया है। Cropty जैसे प्लेटफ़ॉर्म्स ने उपयोगकर्ताओं को यह सुविधा प्रदान करके उनके वित्तीय लक्ष्यों की प्राप्ति में मदद की है, लेकिन यह महत्वपूर्ण है कि उपयोगकर्ता बहुत सावधानीपूर्वक और जागरूकता के साथ क्रिप्टोक्रेडिटिंग की प्रक्रिया में शामिल हों।

The crypto industry, including in India, has seen significant growth in recent years, offering a plethora of ways to generate income. One such method, particularly popular in India, is crypto lending, which allows users to earn interest on their crypto holdings. If you’re new to the world of crypto lending, perhaps in India or elsewhere, you might be wondering: How does crypto lending work? Are crypto loans safe? What are the best crypto lending platforms in India? Are crypto loans worth it? What are the risks associated with crypto lending in India?

Don’t worry. This guide covers everything you need to know about crypto lending, with a particular focus on the Indian market. So, stay focused and keep reading.

What is Crypto Lending?

Crypto lending, a popular practice in India and globally, is a process where investors earn dividends or interest on a daily, weekly, or monthly basis by lending their cryptos to borrowers. The interest rates can reach up to 17% APY, depending on the crypto asset being lent.

Crypto lending is an excellent option for investors, including those in India, who do not want to sell their assets but wish to earn extra money with their idle assets. Furthermore, investors can also borrow loans in fiat (e.g., INR, USD, EUR, CAD) currency against their crypto assets if they need money and do not want to sell their cryptos.

Crypto lending is available for dozens of cryptocurrencies and stablecoins, such as Bitcoin, Ethereum, Cardano, Litecoin, Binance Coin, USD Coin, True USD, etc. The interest rate on cryptocurrencies is up to 7%, but in the case of stablecoins, it can go up to 17%.

How Does Crypto Lending Work in India?

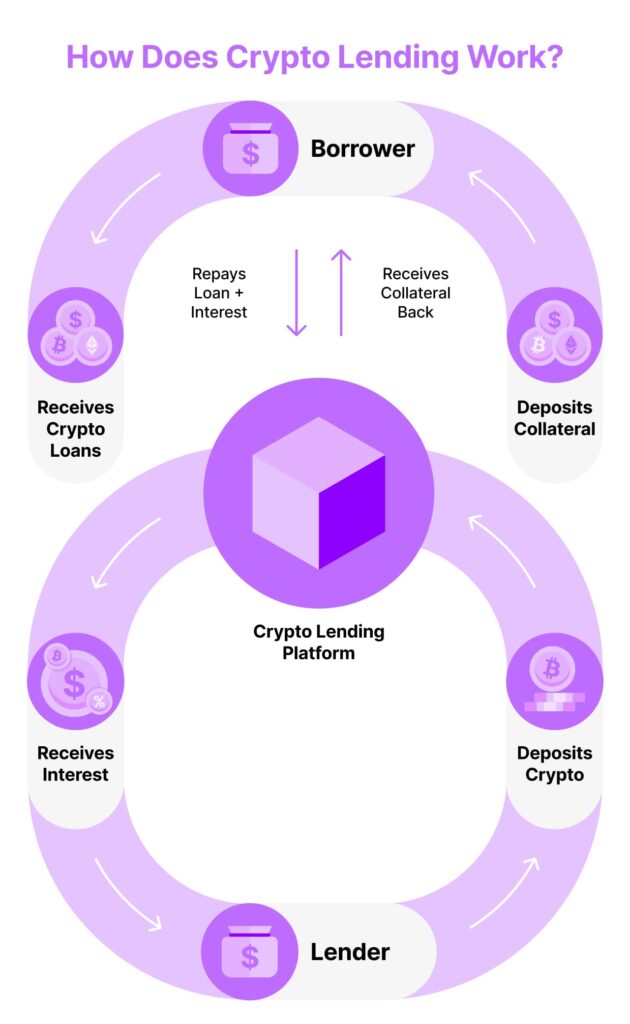

Crypto lending in India involves investors/lenders, borrowers, and a crypto lending platform. The entire lending process is almost the same on every platform, including those operating in India.

An Indian crypto lender deposits his cryptos on a crypto exchange to make them available for lending at a fixed interest rate. A borrower makes a loan request through the platform. He has to stake his cryptos as collateral. Once the platform approves the loan request, funds in the form of fiat or stablecoins are automatically transferred from the lender to the borrower’s account through the platform. The lender receives regular interest paid by the borrower.

The value of the collateral is 100% of the loan amount or most of the time, it is always higher, around 150% of the loan amount. A borrower cannot use his staking until he pays back the entire loan. If the borrower fails to repay the loan, the lender/platform can sell the collateral to cover the losses.

The following figure shows the typical crypto lending process, as it operates in India and elsewhere.

Types of Crypto Loans in India

In India, as in the rest of the world, several types of crypto loans are available, such as:

Collateralized Crypto Loans

Collateralized loans are the most popular type of crypto loan in India and globally. These loans require the borrower to deposit cryptocurrency collateral to secure the loan.

Most platforms in India require a deposit of collateral that exceeds the loan value (loan-to-value: LTV). This is because the interest rate and chances of loss coverage would be lower otherwise.

Uncollateralized Crypto Loans

Uncollateralized loans in India are similar to personal loans. They require borrowers to fill out a loan application and complete identity verification and credit checks to get the loan approved.

These loans carry higher risks of loss for lenders, especially in India, because there is no collateral to cover the loss in case of loan default.

Flash Loans

Flash loans, popular in India and elsewhere, are instant loans that are borrowed and repaid at the same time (in the same transaction).

These loans are risky and are typically used to avail market arbitrage opportunities, such as buying low in one market and instantly selling high in another. This all happens within one transaction, even in the Indian market.

Crypto Line of Credit

Crypto lines of credit are similar to collateralized loans and are offered by some platforms in India. In this type of loan, borrowers can get a loan for a certain percentage of deposited collateral with no set repayment terms.

Interest is paid only on the amount of funds withdrawn. This type of loan is becoming increasingly popular among crypto enthusiasts in India.

Best Crypto Lending Platforms in India

There are several crypto lending platforms operating in the crypto industry, including in India, but choosing the best crypto lending platform is crucial as your lending experience entirely depends on it.

So here we have listed a few parameters to consider before choosing a crypto lending platform in India. Then we have compared the best crypto lending platforms operating in India.

Parameters for Choosing a Crypto Lending Platform in India

There are several crypto lending platforms operating in the crypto industry, including in India, but choosing the best crypto lending platform is crucial as your lending experience entirely depends on it.

So here we have listed a few parameters to consider before choosing a crypto lending platform in India. Then we have compared the best crypto lending platforms operating in India.

Parameters for Choosing a Crypto Lending Platform in India

- Interest rate: Different crypto lending platforms, including those in India, offer interest rates between 2% and 17% depending on the crypto and stablecoins. Choose the one with higher interest rates.

- Supported Cryptos: Platforms, including those in India, support a range of cryptocurrencies, but choosing the right crypto for lending is also important as cryptos are highly volatile. So, check what cryptos a lending platform in India supports.

- Flexibility: Check the lending duration offered by the platform in India and how it acts if a borrower fails to repay the loan.

- Lockup Period: Choose a platform in India that does not require investors to lock assets for a certain period to earn interest.

- Community feedback: Community reviews will significantly help you choose the right lending platform in India. Always choose a well-reputed and trustworthy platform.

Comparison of the Best Crypto Lending Platforms

The following is a comparison of the best crypto lending platforms.

| Cropty Crypto Loans | YouHodler | Crypto.com | CoinLoan | Nexo | |

| Minimum Amount | 1$ | $100 | $250 | $100 | $10 |

| Lending Duration | Unlimited | Unlimited | Up to 90 Days | Up to 3 Years | Unlimited |

| Number of supported coins | 150 | 25 | 35 | 18 | 40 |

| Stablecoins Max APR % | 9% | 12.7% | 12% | 12.3% | Above 12% |

| Payout | When it suits | Weekly | Weekly | 1st Day of Month | Daily |

- Cropty Crypto Loans: Cropty is a highly flexible platform, offering an unlimited lending duration and supporting a wide range of 150 coins, the highest among the platforms compared here. The minimum amount for a loan is as low as $1, making it accessible for small investors. However, its stablecoin max APR is at 9%, which is lower than the other platforms. Payouts are made at the convenience of the user, adding to its flexibility.

- YouHodler: YouHodler is another platform that offers unlimited lending duration. The minimum loan amount is $100, and it supports 25 coins. The platform offers a stablecoin max APR of 12.7%, which is the highest among the platforms compared here. Payouts are made weekly, which might be more suitable for investors who prefer regular returns.

- Crypto.com: Crypto.com offers a lending duration of up to 90 days, which is shorter compared to other platforms. The minimum loan amount is $250, and it supports 35 coins. The platform offers a stablecoin max APR of 12%, and payouts are made weekly. Crypto.com is a well-established brand in the crypto space, which might appeal to investors looking for a platform with a strong reputation.

- CoinLoan: CoinLoan offers a lending duration of up to 3 years, the longest fixed term among the platforms compared here. The minimum loan amount is $100, and it supports 18 coins. The platform offers a stablecoin max APR of 12.3%, and payouts are made on the 1st day of each month. This platform might be more suitable for investors looking for long-term lending opportunities.

- Nexo: Nexo offers an unlimited lending duration and supports 40 coins. The minimum loan amount is $10, making it accessible for small investors. The platform offers a stablecoin max APR of above 12%, and payouts are made daily, which might be more suitable for investors who prefer daily returns. Nexo is a well-known platform in the crypto lending space, which might appeal to investors looking for a platform with a strong reputation.

Pros and Cons of Crypto Loans in India

Crypto lending in India has several advantages, but it also comes with certain drawbacks. Here’s a look at both sides of the coin.

Pros

- High-Interest Rate: Traditional bank savings accounts in India typically offer interest rates around 3-4%, but crypto lending can offer a much higher interest rate of up to 17%.

- No Lockup Period Requirement: Some crypto lending platforms in India offer high yields without requiring cryptos to be locked up for a specific duration.

- Bonus: Many crypto lending platforms in India offer bonuses in crypto or cash for signing up and making a deposit on the platform.

- No credit check: A borrower does not have to go through a credit check to get a loan in India. So, you can get a crypto loan even if you are unbanked.

- Quick Funds: One can receive funds from a crypto loan within a few hours to a maximum within a day in India.

Cons

- No Deposit Insurance: Your crypto assets deposited on the exchange are not insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC) in India, so you have to risk your assets.

- Lockup Period: Some platforms in India require investors to stake assets for a certain period in order to earn interest. During that period, you cannot use your cryptos.

- Turn Over Ownership: You will have to transfer ownership of your crypto assets to the company and trust it with your assets. If the company shuts down, you will lose your assets.

- Provide more collateral: As a borrower in India, if the value of collateral drops below the loan value, you will have to deposit more collateral. Otherwise, you may lose your cryptos.

- Inadequate Insurance: In case of any hacking event, the insurance provided by the platform may be far less than the funds you deposited at the platform.

Risks of Crypto Lending in India

Whether you are an investor or borrower, crypto lending in India is risky. The following are a few risks associated with crypto lending.

Margin calls

When a borrower deposits his collateral to get a loan against it, and if the value of deposited collateral drops below the loan value, it can trigger a margin call in India.

When it happens, the borrower has to either deposit more collateral so that he can get it back after paying the loan or the platform will liquidate it to cover the losses.

Illiquidity

When you deposit your funds onto a crypto lending platform in India for lending purposes, they become illiquid, and you cannot use them. However, some platforms allow investors to withdraw their deposited funds quite early, which will not be the case on other platforms, and you will have to wait a long time to access your funds.

No protection

Crypto lending platforms in India are not regulated like traditional banks. That’s why they do not offer the same protection as banks do. For instance, Indian banks are insured by DICGC for up to ₹5 lakh per account holder. It means in case of any mishap, and the bank becomes insolvent, DICGC will compensate users’ funds up to that limit.

But in crypto lending, there is no such protection for investors, and in case of the platform’s insolvency, users will lose their funds.

Smart contract risk

Crypto lending platforms in India use smart contracts to automate the lending process, such as paying interest, collateral liquidation, etc. Smart contracts are code, with no human control over them.

It means if the smart contract does not work, you cannot rely on anyone, and you alone have to bear the risk, and you may lose your cryptos in the worst case.

The Safety of Crypto Lending in India

Given the inherent risks associated with crypto lending, it would be misleading to claim that the practice is entirely safe. However, there are strategies that, when adopted, can enhance the safety of crypto lending.

To mitigate risks and maximize potential returns, consider the following guidelines:

- Stay abreast of the evolving crypto regulations in your region or country, such as India. Regulatory changes or enforcement actions against a platform could result in the loss of your funds.

- Opt for a reputable and established crypto lending platform. Legitimate platforms employ rigorous measures and collaborate with specialized providers to safeguard users’ funds. Investigate the platform’s security protocols to understand how your investment is protected.

- Favor stablecoins over cryptocurrencies for lending and borrowing. Cryptocurrencies are subject to high volatility, which can impact your ability to sell your coins if prices drop. Conversely, borrowers may need to deposit additional collateral if prices rise. Stablecoins, which are pegged to assets like the U.S. dollar or gold, are not subject to the volatility of the crypto market.

Securing a Crypto Loan in India: A Step-by-Step Guide

Obtaining a crypto loan in India is a straightforward process:

- Register on a crypto lending platform or link your wallet to the platform.

- Choose the collateral to deposit and the amount you wish to borrow.

- Upon depositing the collateral on the platform, funds will be instantly transferred to your account. The received funds typically range from 50%-90% of your collateral.

Most crypto loans in India are instantly approved with set lock-up terms via a smart contract.

If you’re interested in lending a crypto loan, the process is similar. Simply replace the step of depositing collateral with depositing funds for lending. Interest amounts will be automatically transferred to your account.

Conclusion

While crypto loans carry inherent risks, these can be minimized by adhering to the guidelines outlined in this article. Thorough research is key to selecting the best crypto lending platform in India, enabling you to earn high interest rates on your idle assets with minimal effort.